It is said that Albert Einstein once noted that the most powerful force in the universe was the principle of compounding. In investing and finance, this force manifests itself through the concept of compounding interest.

In simple terms, compound interest means that you begin to earn interest on the interest you receive, which multiplies your money at an accelerating rate.

In other words, if you have $500 and earn 10% in interest, you have $550. Then, if you earn 10% of interest on that, you end up with $605. And so on, until eventually, your original $500 is eclipsed by the amount of interest you have gained.

This is the reason for the success of many top investors. Anyone can take advantage of the benefits through a disciplined investing program.

Three Elements That Determine Your Compound Interest Returns

- The interest rate you earn on your investment, or the profit you earn. If you are investing in stocks, this would be your total profit from capital gains and dividends.

- Time left to grow. The more time you give your money to build upon itself, the more it compounds.

- The tax rate, and when you have to pay taxes on your interest. You will end up with far more money if you don’t have to pay taxes at all, or until the end of the compounding period rather than at the end of each year. This is why accounts such as the traditional IRA, Roth IRA, 401(k), SEP-IRA, and other tax-deferred IRAs are so important.

Compound Interest and the Time Value of Money

The foundation behind compounding interest is the concept of the time value of money, which states that the value of money changes depending upon when it is received. Having $100 today is preferable to receiving it a years' time from now because you can invest it to generate dividends and interest income. Compounding interest allows that money to grow. By postponing the receipt of the $100, your opportunity cost grows.

Opportunity cost is the loss of possible gains if an action is not chosen—in this case, the amount of money you do not receive if you take no action with it. If you did not invest the $500, you have lost the opportunity to earn $50 you could have gained in a year. In 10 years, your $500 would have been $1,427—you have lost the opportunity to gain $927 by not investing the money.

When you understand the time value of money, you'll see that compound interest and patience are the ingredients for wealth. As an example, if you wanted $1 million for retirement, and could save $800 per month, with 8% per year on your investments, would you be able to? The U.S. Securities exchange commission provides a calculator to help you figure out how long it would take (in this scenario, you'd break $1 million in 29 years).

Compound Interest Results Over Time

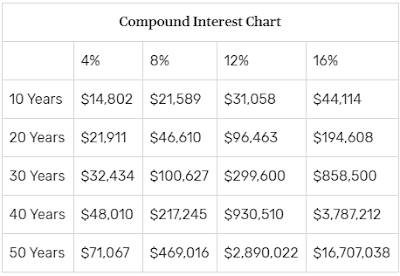

The best way to understand these concepts is to put them into a compound interest table that shows you just how substantially your wealth can multiply over time.

Imagine you have an investor who sets aside a lump sum of $10,000. Take a look at the compound interest chart to see the influence of time and rate of return on his ultimate wealth. Once you understand this, it becomes evident that saving money alone is not the key to a large fortune.

For instance, a 20-year-old that invests $10,000 today and parks it in Treasury bills, earning 4% on average for the next 50 years, will find himself with $71,067 if the purchases were made through a tax-free account such as a Roth IRA. Had he invested in stocks and real estate, earning a 12% average rate of return over the same time, he would have ended up with $2,890,022. Adding higher returning asset classes would result in over 40 times more money thanks to the power of compound interest.

Resist the Temptation of Higher Returns Through Risk

One glance at the compound interest chart and you may want to do whatever it takes to earn a higher rate of return. Higher return rates can be dangerous because higher rates of return always bring higher risk. Unless you know what you're doing, no matter how successful you are along the way, you always want to avoid the possibility of losing more than a budgeted amount of investing principle.

Benjamin Graham, known as the father of value investing, was aware of this risk when he said that more money has been lost reaching for a little extra return or yield than has been lost to speculating. He warned that it is one of the greatest temptations new investors face when building a portfolio.

EmoticonEmoticon